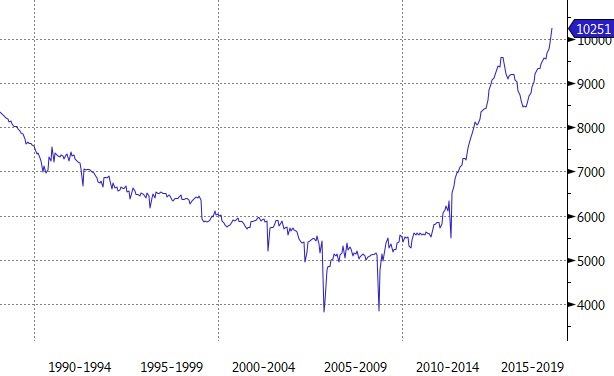

The U.S. energy industry just hit a milestone that was nearly 50 years in the making. Last week, the Energy Information Administration (EIA) reported that U.S. crude oil production reached 10.3 million barrels per day, the highest level in the country’s history and the first record since 1970.

It was back then that the U.S. was last producing more than 10 million barrels per day, and it only did so briefly. As geophysicist Marion King Hubbert famously predicted, 1970 marked “peak oil” for the U.S., after which output steadily declined for the next four decades or so.

Now output is back on the rise thanks to new technological breakthroughs, including but not limited to, hydraulic fracturing (or “fracking” for short).

US Crude Oil Production

Source: EIA, Bloomberg

The U.S. crude oil renaissance isn’t new. The first seeds began to sprout almost a decade ago, and production really took off between 2012 and 2014. But the collapse in crude oil prices between mid-2014 and early 2016 put a sudden halt to the boom. With the industry cleansed of its excesses, and oil prices up more than double from their $26 bottom of two years ago, another boom has begun.

Since U.S. production bottomed in mid-2016, it’s up 1.8 million barrels per day. Just since the start of this year, output is up nearly half a million barrels per day.

Production Surge Sustainable

Most forecasters assume the rapid rise in U.S. production will continue for the foreseeable future. The U.S. has already surpassed Saudi Arabia—which produces 10 million barrels per day—as the world’s No. 2 oil producer, and could soon surpass No. 1 producer Russia’s 11 million barrels per day.

The EIA anticipates U.S. output will average 10.6 million barrels per day this year and 11.2 million barrels per day next year.

Analysts at Credit Suisse have an even more aggressive prediction. They see output hitting 11.7 million barrels per day in 2019, and growing to 13.4 million barrels per day in 2022.

Unlike the last time U.S. oil production was growing by leaps and bounds, this time, prices are holding up pretty well. Brent crude oil futures hit a three-year high of $71 at the end of January, though they’ve since fallen to around $63. But even after the pullback, prices are up nearly 13% from a year ago.

At the same time, the futures curve is in backwardation, something that tends to happen when the market fundamentals are strong.

Market ‘Clearly Tightening’

There are a few reasons why the oil market has been able to absorb the influx of supply out of the U.S. so well this time around. For one, the Organization of Petroleum Exporting Countries is still adhering to production cuts that have been in place since the beginning of 2017.

Secondly, geopolitical factors have also played a role both tangibly and intangibly. The possible unraveling of the Iran nuclear deal; disruption to Libya’s oil industry; and mounting concerns about Venezuela’s oil production are three of the biggest areas of concern, according to the International Energy Agency (IEA).

“The oil market is clearly tightening; in three consecutive quarters—2Q17-4Q17—OECD crude stocks fell by an average of 630,000 barrels per day; such a threesome has happened rarely in modern history,” said the IEA.