Thematic ETFs can quickly gather steam if a theme catches investors’ imagination. Blockchain ETFs are the latest in hot themes served up in ETF wrappers.

In a matter of days last month, ETF investors gained access to four different blockchain ETFs. The rush to capture the investment case of the digital ledger technology behind cryptocurrencies (such as bitcoin) is on. In less than a month, nearly $300 million in new assets have flowed to these funds.

Truly accessing a theme is no a easy task, as you can’t easily isolate a revenue stream associated with a specific theme in a company’s numbers. Blockchain is no different.

Finding pure-play companies in blockchain is practically impossible, according to Spencer Bogart, partner at Blockchain Capital. Most people don’t even fully understand how it works.

No Pure-Plays

“There’s simply no pure-play public company exposure to the space,” Bogart said. “Even for the publicly traded companies that have exposure to crypto and/or blockchain, it’s likely a small percentage of their overall business.”

“I’m not opposed to issuers trying to create thematic ETFs based around blockchain and crypto, but these are early days from a public markets perspective,” he added. “Prospective buyers should really understand the actual exposure they’re buying.”

Each issuer is going about accessing the blockchain theme differently. These are competing funds that are built very differently.

The good news is they all screen for liquidity, making sure these are securities you can easily get in and out of—that can sometimes be a challenge in thematic ETFs. They also screen out the companies that are making headlines simply by adding “blockchain” to their name or to their “strategic initiatives” as a quick ploy to boost stock prices.

And they all have their price tags in the same ballpark, around 0.65-0.70% in expense ratio.

Here’s a quick look under the hood at these ETFs:

Amplify Transformational Data Sharing ETF (BLOK)

Launched: Jan. 16, 2018

Expense ratio: 0.70%

AUM: $162 million

BLOK is a global-in scope portfolio of companies, but what’s unique about BLOK is that it’s the only actively managed blockchain ETF. The decision to go active centers on the issuer’s belief that blockchain is still an emerging technology, and one that’s changing too quickly to be best accessed through an index that reconstitutes twice a year.

The fund seeks companies that match one of three criteria: those that are leading in collecting revenue from blockchain; those that are leading in research efforts; and those that are leading investment in private companies in this segment.

The active management approach allows the fund to pursue that purity more nimbly, Christian Magoon, head of Amplify, told ETF.com. BLOK also dips into smaller-cap companies for exposure.

(Inside ETFs Video: Magoon On Blockchain ETFs)

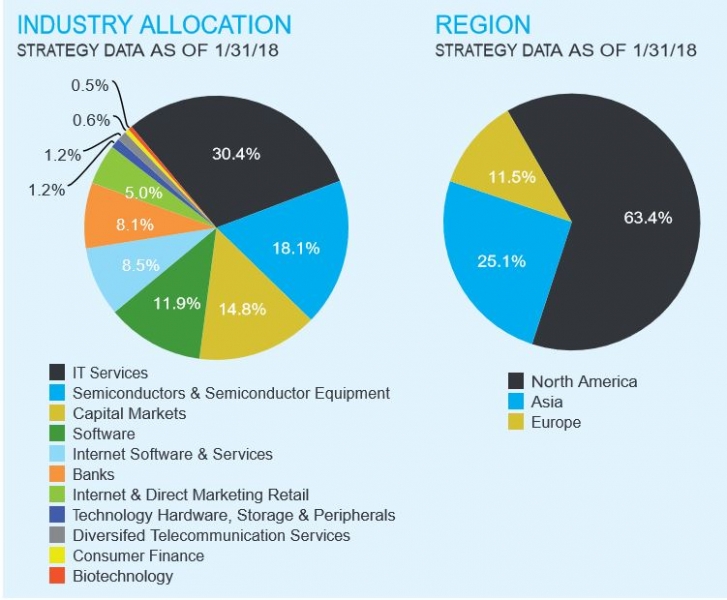

The portfolio, as one might expect, is heavy on tech names, but also offers exposure to sectors such as financials and health care/biotech. Top 10 holdings include names like Taiwan Semiconductors, Overstock, Nvidia and HIVE Blockchain Technologies, each representing about 4 to 6% of the mix.

Here’s what the portfolio looks like right now:

Source: Amplify